Welcome to our third edition of Sentiment Crunch. In the first two episodes, we decided to offer a lot of granular details on consumer sentiment across two sectors. This time, after reviewing the feedback we have decided to crunch it into a simple article rather than an exhausting, boring, and at times overwhelming report. Of course, those interested in understanding market intelligence across various sectors, have the option to connect with us for a cup of hot coffee. Past two months we wrote about Leisure & Entertainment and Restaurants. This time we will offer some valuable insights into Hotels. Check-In!

The growth of the hotel industry in the UAE has been nothing short of phenomenal over the past few decades. It has become a world-renowned destination for tourism, attracting millions of visitors each year from all over the globe. This growth has been driven by several factors, including the country’s strategic location and excellent infrastructure.

Top 20 Source Markets for Visitors (2019, 2021, 2022)

According to a study by Knight Frank, a leading real estate consultancy, the UAE’s hospitality market has been growing steadily over the past few years and is expected to expand by 25% by 2030. The study predicts an addition of 48,000 rooms to the current portfolio of 200,000 rooms. Dubai, which already has a portfolio of 130,000 rooms, is expected to account for 76% of the new rooms. Supporting these trends, a recent report by JLL Mena suggested that the occupancy rate of hotel rooms in Dubai went up to 72.9% in 2022 from 69% in 2021, but slightly behind pre-pandemic numbers and 2019 75.3%.

Many rely heavily on CSAT, or NPS, which are rating-based measures that do not tell the ‘why of things and could be culturally perceived too. In this report, we focus on an understanding mix of traditional (NPS, CSAT) and modern indicators (Sentiment, Relevance/Importance). KPIs we will touch base on in this report include:

To provide the most realistic outlook we have developed a ranking index that considered the quality of feedback data. This way we ensure that we eliminated potential fake feedback and low-quality data points that only focus on ratings, which are not in our opinion representative of performance. This report is a summary of an extremely large set of consumer data that includes over 140,000 customers and of course, sentiment insights on their valuable opinions collected from over 100 hotels across the United Arab Emirates.

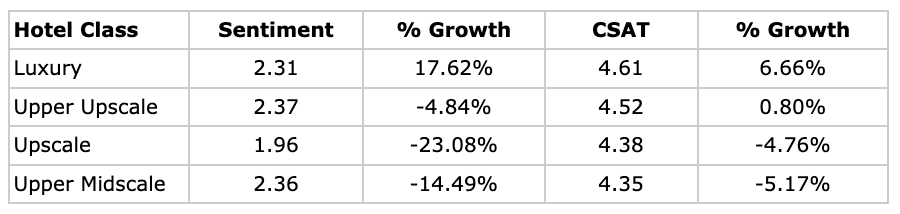

The 2022 data shows that the Luxury hotel class had the highest growth in sentiment with 17.62%, while the Upscale class had the lowest with a decrease of 23.08%. The luxury class had the highest growth of 6.66% and the Upper Midscale decrease of 5.17%.

The data suggest that Luxury hotels are performing well in terms of both sentiment and customer satisfaction, while the Upscale class may need to focus on improving their scores.

The United Arab Emirates is one of the key countries in the Gulf region which has been contributing a major share to the hospitality industry. The data provides sentiment analysis and customer satisfaction scores for several hotel chains. The sentiment score is measured from 2022 and the percentage growth is provided from the previous period.

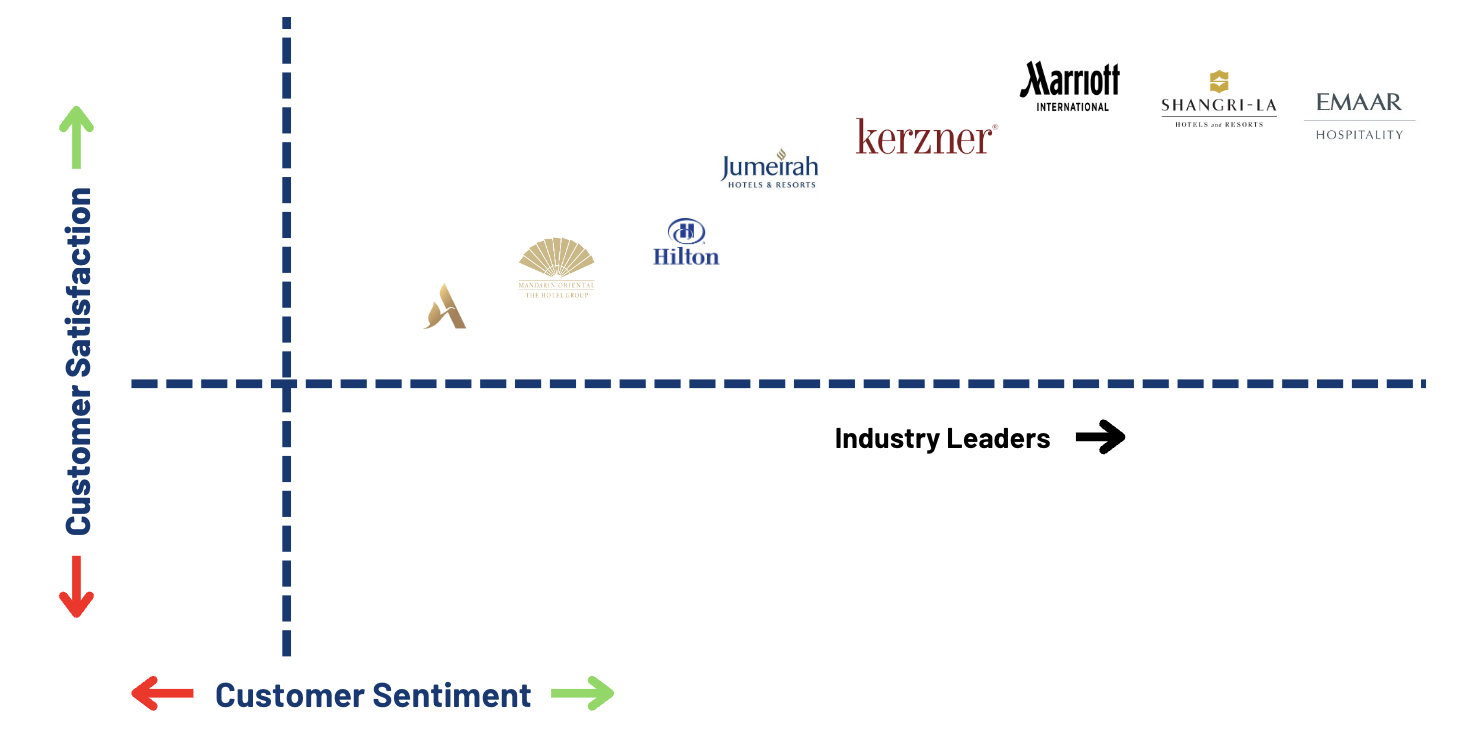

2022 Leaders Quadrant by CSAT and Sentiment Performance

The data shows that Kerzner International had the highest growth in sentiment with 36.37%, while Shangri-La had the lowest with a decrease of 12.38%. The customer satisfaction (CSAT) score is also measured as a percentage growth from the previous period, with Marriott having the highest growth of 6.65% and Hilton having the lowest with a decrease of 1.58%. The data suggest that Emaar and Marriott are performing well in terms of both sentiment and customer satisfaction, while Mandarin Oriental, Accor, and Hilton may need to focus on improving their scores.

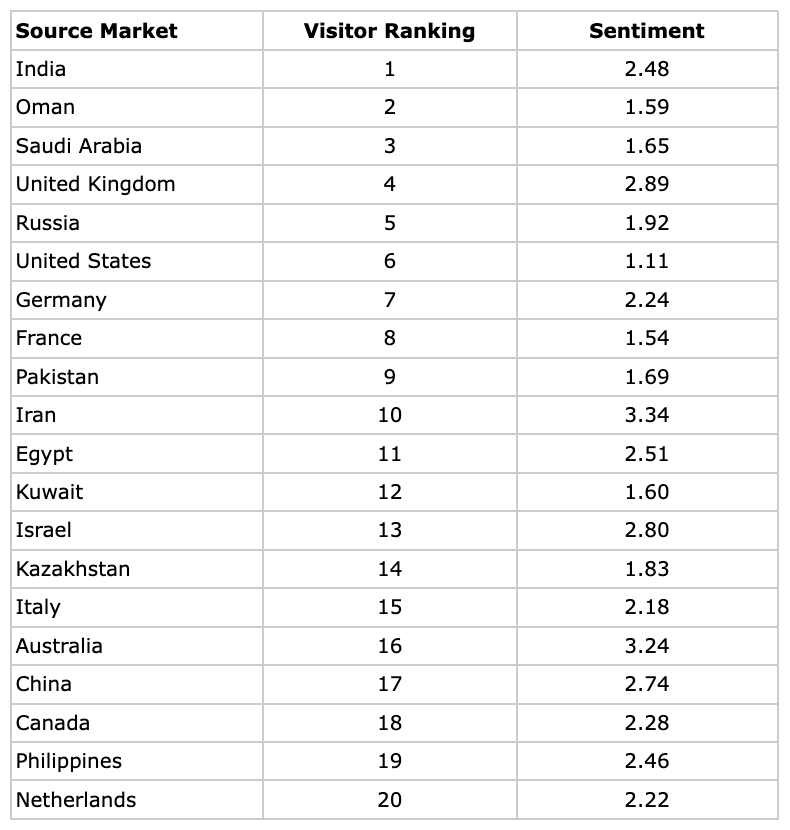

The data shows a ranking of source markets based on visitor arrivals, along with the corresponding sentiment score for each market. India is the top-ranked source market for visitors, with a sentiment score of 2.48. Iran has the highest sentiment score of 3.34, followed by Australia at 3.24 and the United Kingdom at 2.89. The United States has the lowest sentiment score of 1.11, with Saudi Arabia, Oman, France, and Kuwait also having relatively low scores. The data suggests that main source markets scored lower than others, which could potentially impact the tourism industry in the region if CX is neglected.

Top 20 Source Markets: Visitor Ranking vs Sentiment Performance

Major KPI Performance for 2022:

While we noted in this article that some major market visitors do not have the best possible experiences across UAE hotels, it is important to note that the overall market performed very well in 2022 across some major CX indicators. In some future writeups, we will go into more detail on topics that we analyzed and include Rooms, Service, Value for Money, Location, Cleanliness, Amenities, Facilities, and F&B. We felt this would be overwhelming this time around.

For now, we will Check-Out in hope that we provided some interesting insights! Till next time, keep well. 👋